Can sell Lead @ cmp 152.25, tgt is open, I will update stop loss & tgt latter. Do the trade, if you are positional trader. Short term or intraday traders keep away from this idea. It can take 20 days to 1 month for exit.Jay Shriram.

Update 1, 22nd Feb 2017, 10.39 a.m

After breaching the supportline placed @ 150.50, lead price will tumble down heavily. Intraday traders can also earn some money when it happens. Thank you, Jay Shriram.

Update 2, 23rd feb 07.50 pm

What is decending triangle ? look @ the chart and read the folowing post below it.

Given is the lead hourly chart. Descending Triangle is shown in the chart.

The descending triangle is a bearish formation that usually forms during a downtrend as a continuation pattern. There are instances when descending triangles form as reversal patterns at the end of an uptrend, but they are typically continuation patterns. Regardless of where they form, descending triangles are bearish patterns that indicate distribution.

Because of its shape, the pattern can also be referred to as a right-angle triangle. Two or more comparable lows form a horizontal line at the bottom. Two or more declining peaks form a descending trend line above that converges with the horizontal line as it descends. If both lines were extended right, the descending trend line could act as the hypotenuse of a right triangle. If a perpendicular line were drawn extending up from the left end of the horizontal line, a right triangle would form. Let's examine each individual part of the pattern and then look at an example..... to read full article , visit http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:chart_patterns:descending_triangle_continuation

Update 3, 28 th Feb 2017, 04.35 pm, lead hourly chart,

This is a Lead hourly chart. You can see price moving in a downward channel. On many traders chatting platform, you can read that," the commodity is going upward again." But the chart says something different. Price is very much intact in downward moving channel, taking support from supportline & turn south from resistance line. Now it is kissing R1 152.17, Prior low 149.50 should work as S1. Then there is major support namely S2 which is placed @ 148. If Lead break this support then that will be a confirmation of major downtrend. Thank you.

Update 4, 2nd Mar 2017, 10.00 pm

Lead broke upward moving channel and entered in bearish environment today. See the chart and read remaining post below it.

You can see in this 30 min chart that, lead entered in up moving channel on 23rd Feb, from that day till today. But today it broke this channel downward in a significant way. Now it is confirmed that it is in bearish trend. I marked point from where it broke the channel. So we are with the trend. May be there are little up & downs but we finally get our tgt.

update 5, 3rd Mar 2017, 08.03pm

Now lead is trading in declining triangle. which often gives bearish breakout after completion of pattern.

Update 6, 6th Mar, 10.54 am.

Look @ the chart, declining triangle -- bearish breakout.

Update 7, 7th mar, 01.15 pm

As seen in this 30 min chart, lead price retracement ( upward ) ends kissing our redline, which is shown in circle. This is rule of polarity. while in the down move, lead price took support from this support line , which is now become resistance line. same time 61% fib is placed there. Each and every thing is now with us. we can expect big fall anytime hereon.

Update 8, 15th March 2017, 05.33 pm

Rule of polarity worked. Lead price returned downward taking resistance from the prior support of 147. see the 30 min chart of mcx lead

Update 9, 18th Mar 2017, 02.00 pm

Lead mcx daily chart.

please see the attached daily chart of lead. Price is moving in a downward channel. Even it is below middle line (red) of the bollinger band, which is bearish sign. It just touched resistance line of sub channel (green). What is wrong with it ? You can see the daily chart and suggest me. It is clearly moving down and down within the channel (down moving) touching support line and resistance line again and again. that's what I can read in the chart. If there is an mistake of reading the chart by me, please suggest me the same. Keep writing,

thanking you,

vaibhav

Update 10 24th Mar, 05.24 am

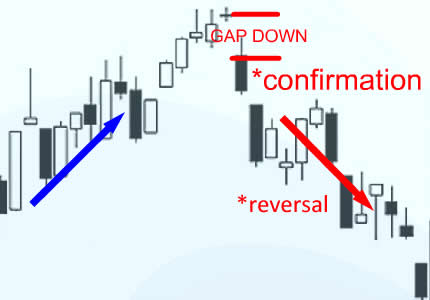

Evening Doji star on examples

Lead chart 24 arch closing

MCX lead chart

The Evening Star and Evening Doji Star are top reversal patterns consisting of three candlesticks. Similar to the evening here on earth predicting that darkness will soon fall down upon the earth, the evening star candlestick pattern suggests that prices will fall. The first day of the evening star pattern consists of a long bullish candlestick after a preceding uptrend. Next, the second day candlestick gaps up, this means that the candlestick opens at a higher price than the first day’s closing price. The second day candlestick should be a little candlestick and technically, can be either bullish or bearish; but the main idea is that the real body of the second day is above the real body of the first day.

Lastly, the third day of the evening star pattern is a large bearish candlestick that closes well into the first day’s bullish candlestick real body. The charting package of ThinkorSwim (2011) requires that the third day candlestick close below the midpoint of the first day’s candlestick real body. Moreover, it is preferable if the third day’s candlestick gaps down, but this is not absolutely required for the pattern to be valid.

In the case of MCX Lead same thing is happened and the Evening Doji Star appears. as this is reversal pattern, price is likely to go down significantly. On the first day of this candlestick pattern on mcx lead chart, there is long bullish ( green ) candle on 22nd March 2017. But point to be noted is that there is no gap up opening on second day which is yesterday 23rd March. First days close was 154,75 and second day opening marked at 154.45. But the the real body of the second day is above the real body of the first day.

Conclusion --- Lead price can take reversal on downside from today onward.

Last update, 19th april 2017.

mcx lead daily chart

This is last update on this lead post because we booked our profits yesterday around Rs 136. We shorted it at 152 -- 153 around before 2 months. It was very difficult to hold position for such a long period, but we hold it and got profit of more than Rs 80000 in single lot short position. there were many occasions when we hold this position in loss, price went up to 157 + but we hold it. finally god gives us gift of this profit.

I am closing this post now. Last few words about lead --- use every rise in

price to create short position because it is in declining triangle on daily chart.

you can see it in attached chart.

Thanking you, Jay Shriram.